Clark Wealth Partners Can Be Fun For Everyone

Table of ContentsClark Wealth Partners Fundamentals ExplainedThe 6-Second Trick For Clark Wealth PartnersNot known Incorrect Statements About Clark Wealth Partners The Basic Principles Of Clark Wealth Partners The Best Guide To Clark Wealth PartnersThe 45-Second Trick For Clark Wealth PartnersClark Wealth Partners Things To Know Before You Buy7 Simple Techniques For Clark Wealth Partners

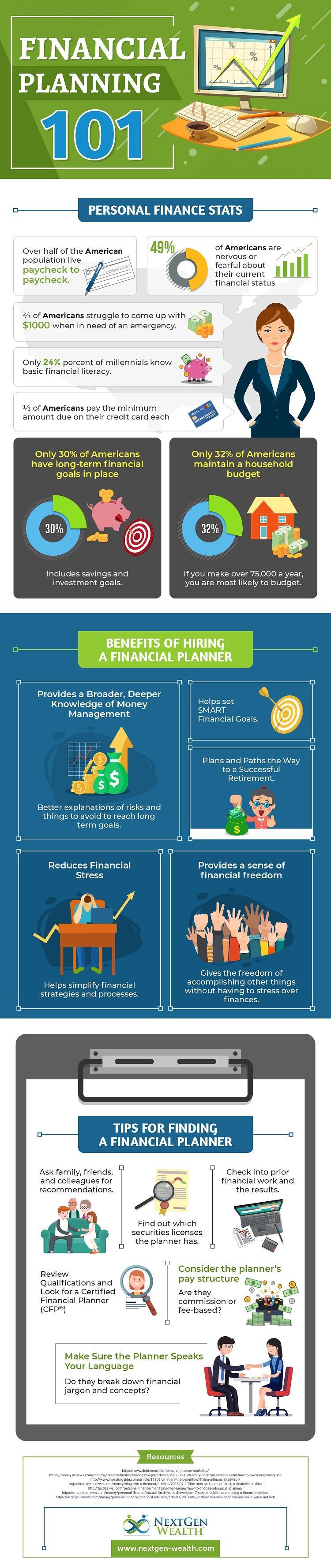

Typical reasons to think about an economic consultant are: If your monetary scenario has actually ended up being a lot more complex, or you do not have self-confidence in your money-managing skills. Saving or browsing major life events like marital relationship, divorce, youngsters, inheritance, or job adjustment that may substantially impact your monetary situation. Navigating the shift from saving for retirement to preserving riches throughout retired life and how to create a strong retirement earnings strategy.New modern technology has brought about even more thorough automated financial devices, like robo-advisors. It's up to you to explore and identify the right fit - https://www.40billion.com/profile/714727223. Inevitably, a great financial expert needs to be as conscious of your financial investments as they are with their very own, preventing too much costs, conserving cash on taxes, and being as clear as feasible regarding your gains and losses

The Ultimate Guide To Clark Wealth Partners

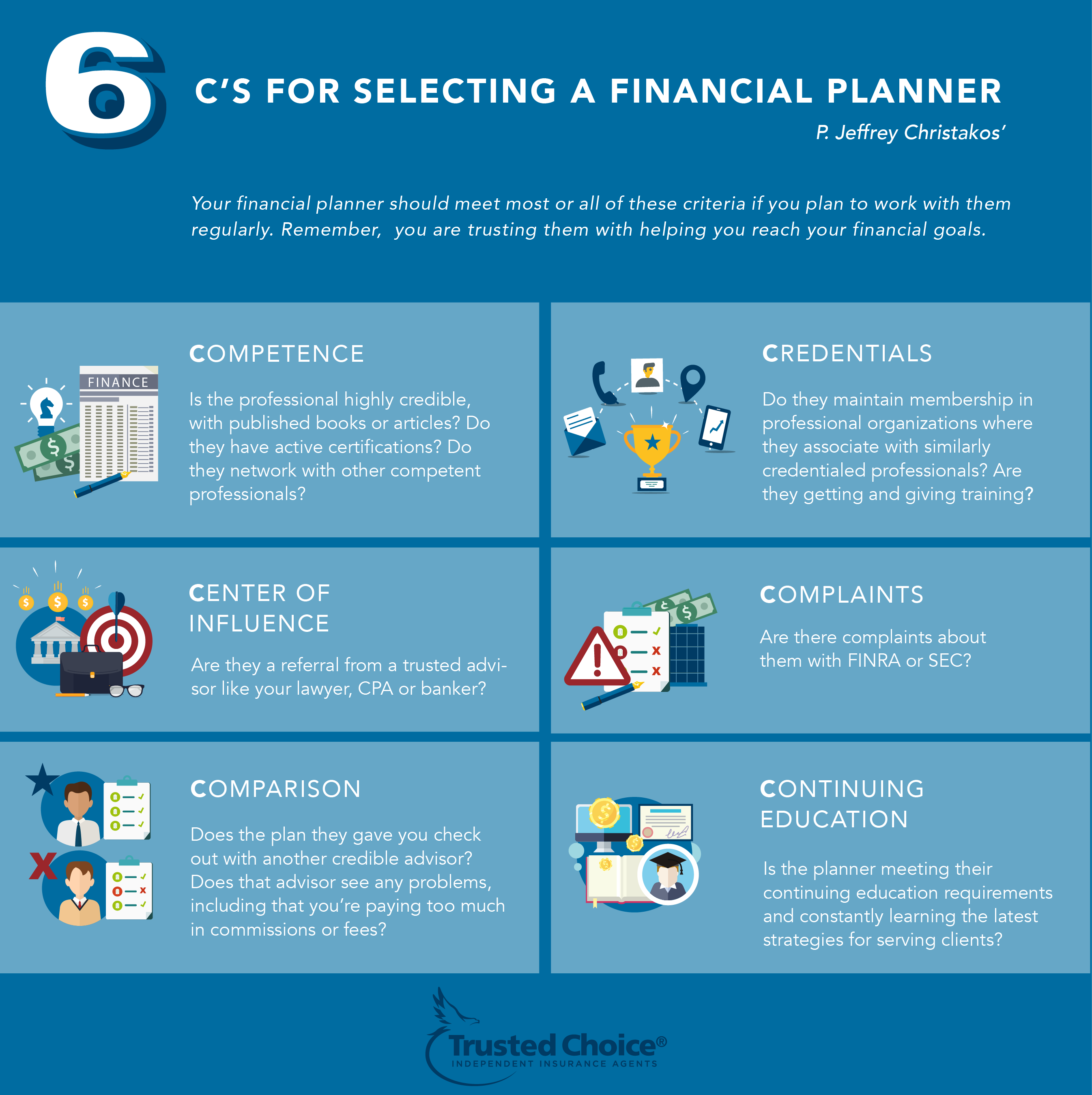

Earning a payment on item suggestions does not necessarily mean your fee-based expert functions against your ideal passions. They might be much more likely to suggest items and services on which they make a compensation, which may or may not be in your ideal rate of interest. A fiduciary is lawfully bound to place their client's interests.

They might follow a freely monitored "viability" requirement if they're not signed up fiduciaries. This basic permits them to make suggestions for financial investments and services as long as they suit their client's goals, danger tolerance, and monetary situation. This can convert to referrals that will additionally earn them money. On the various other hand, fiduciary experts are lawfully obliged to act in their customer's benefit as opposed to their very own.

Getting The Clark Wealth Partners To Work

ExperienceTessa reported on all things spending deep-diving into complicated monetary subjects, losing light on lesser-known investment avenues, and discovering ways viewers can work the system to their advantage. As an individual financing specialist in her 20s, Tessa is really familiar with the effects time and unpredictability carry your financial investment decisions.

.jpeg?width=386&height=338&name=6%20Money%20Decisions%20Graphic%20(R).jpeg)

It was a targeted ad, and it functioned. Find out more Review much less.

Clark Wealth Partners Things To Know Before You Buy

There's no single route to ending up being one, with some people beginning in financial or insurance coverage, while others start in accounting. A four-year degree offers a solid structure for careers in investments, budgeting, and client services.

Not known Facts About Clark Wealth Partners

Usual instances consist of the FINRA Collection 7 and Series 65 tests for safety and securities, or a state-issued insurance policy license for selling life or medical insurance. While credentials might not be legally required for all preparing roles, companies and customers frequently see them as a criteria of expertise. We take a look at optional qualifications in the following area.

Most financial organizers have 1-3 years of experience and experience with financial items, compliance requirements, and direct client interaction. A strong educational background is vital, however experience demonstrates the ability to apply theory in real-world settings. Some programs combine both, allowing you to finish coursework while earning supervised hours with teaching fellowships and practicums.

The 8-Minute Rule for Clark Wealth Partners

Many get in the field after operating in banking, accounting, or insurance coverage, and the transition needs determination, networking, and frequently sophisticated credentials. Very early years can bring lengthy hours, pressure to build a customer base, and the demand to constantly show your proficiency. Still, the job uses strong lasting capacity. Financial organizers enjoy the opportunity to work very closely with clients, overview essential life choices, and frequently achieve flexibility in timetables or self-employment.

Riches managers can boost their revenues via compensations, property charges, and efficiency incentives. Monetary supervisors manage a team of financial coordinators and consultants, setting departmental approach, handling compliance, budgeting, and routing interior operations. They spent less time on the client-facing side of the industry. Almost all economic managers hold a bachelor's degree, and several have an MBA or comparable academic degree.

Clark Wealth Partners for Beginners

Optional accreditations, such as the CFP, typically call for extra coursework and screening, which can expand the timeline by a number of years. According Read Full Article to the Bureau of Labor Data, personal financial consultants make a median annual annual salary of $102,140, with leading earners gaining over $239,000.

In various other provinces, there are laws that require them to satisfy specific demands to utilize the financial advisor or monetary organizer titles (financial advisors Ofallon illinois). What sets some monetary advisors aside from others are education and learning, training, experience and qualifications. There are many classifications for economic consultants. For monetary coordinators, there are 3 typical designations: Licensed, Individual and Registered Financial Planner.

The 8-Minute Rule for Clark Wealth Partners

Where to find an economic consultant will certainly depend on the type of advice you require. These organizations have team that might help you recognize and buy specific kinds of financial investments.